The inverted yield curve, for a few days, is in the limelight of the world economy. Amid the slide in the bond and financial markets of the USA and Europe, according to the Wall Street Journal, investors and economists are worried if recession is just around the corner. The situation has taken place as yield on the short-term bond is outperforming the same on the long-term bond in the US bond market.

Statistics by The New York Times show that the yield on the 10-year Treasury note fell to 2.44 percent, the lowest level since January 2018. That was just below the 2.45 percent yield on the three-month Treasury bills. This further escalated the gossip on whether the global economy was running out of steam. In fact, The January 2019 edition of the Economist magazine argued that globalisation has given way to a new era of sluggishness, which is construed as “The Slowbalisation”. And Business Insider also stated that the US economy was performing below what President Trump had been promising for a year.

Likewise, given the trade war between China and USA, the Brexit impasse that could probably topple Theresa May from the prime ministership, and the recent statistics from the capital market are raising tensions amongst investors in the global market. However, this is not new to investors. A similar situation – an inverted yield curve – was also faced by the US economy back in 2018. However, whether the current inverted yield curve would engender a recession in the global economy is neither the reach nor an attempt of this discussion. Rather, let’s try to understand why the stakeholders are ogling the yield curve. Similarly, the discussion will further focus on how the Nepali economy might be affected should recession take place in the near future.

First of all, one has to understand what the yield curve is all about, and how it signals the economic stability of a country or a region. In a nutshell, yield is the interest or return an investor receives from a bond. And, the yield curve measures the yields of the total bond trading in the market.

Under normal economic conditions, any decent finance book will tell you that yields on short-term bonds are less than those on long-term bonds. That is to say, the normal yield curve is upward sloping: when we put bond maturity in x-axis and yield on y-axis.

This principal is based on a simple fundamental that “higher the risk, higher the profit”, that is, the long-term bonds are riskier than the short-term bonds. However, when these normal conditions do not match or the yield curve gets “inverted”, long-term interest rates fall below short-term ones. This happens when investors lose confidence in the future economy. They tend to invest in some safe instruments, like longer-term bonds, raising the demand and price of the bond and hence reducing the return on the same: there is negative relationship between the price of the bond and return. This drags the yield curve down in longer-term bonds, causing inversion in the curve.

Similarly, it is also important to note that any correction that the central bank tries to make by intervening in the interest rate has a direct and decisive impact on the short-term government bonds. Thus, sometimes freeing the interest rate from a tight hold on short-term federal bonds also causes the same. Thus, let’s analyse why everyone is scared of this “yield curve inversion”.

According to The New York Times, every big economic recession in the United States is preceded by this unnatural phenomenon.

Indeed, Prof. Campbell Harvey, who first reckoned the predictive power of the yield curve, argued that to be precise on the signal of an inverted yield curve, it must last on average for three months. And if it does so, he states that recession’s history repeats over the next nine to eighteen months.

At the same time, other economists are also arguing that since this inversion does not cause overnight recession, the Federal Reserve Bank has enough time to intervene in the market and correct it.

Against this scenario, it is also important to analyse how this inverted yield curve will affect the Nepali economy. Recalling history, it is safe to argue that the Nepali economy is to a larger extent independent of global recession. It may be due to the fact that about 70 per cent of the economy is dependent on the service and agriculture sector combined. These sectors do not directly get affected by global recession.

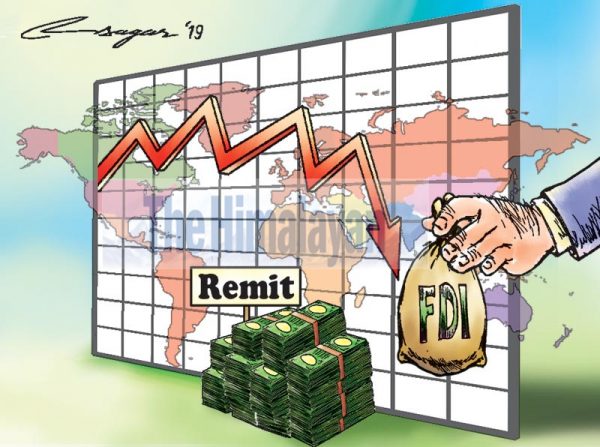

Similarly, since the Nepali capital market is not open to foreign investors, and Nepali individuals and institutions are not allowed to invest in foreign markets, there is no direct effect of global financial recession on the Nepali economy. However, it is also important to note that Nepal receives a larger portion of remittance through foreign employment, which is the major source of forex reserve, and hence the only funding source for international trade.

Likewise, the effect could also be seen on foreign direct investment and foreign aid. In summary, though severe effects will not be seen in the Nepalese economy as global firms are not present in the Nepali economy, the economy is not free from the trap of global recession. After all, the recession makes no one better off.

Bist is with the research department of Uniglobe College

This article was published in National Daily newspaper – The Himalayan Times, and you can also ready from following links.

https://thehimalayantimes.com/opinion/inverted-yield-curve-is-nepali-economy-safe/